Widows Savings and Loans Associations (WISALAs) are “micro-banks” each owned by 25 widows that provide a pathway to sustainable livelihoods and decent standards of living to widows and their dependents.

The WISALA model is a wraparound approach that does more grant credit. It is a three-pronged approach:

It's capital investment model makes it possible for

Common barriers to financial inclusion are removed;

The autonomy of widows is utilized for success:

Widows Savings and Loans Associations (WISALAs) are “micro-banks” each owned by 25 widows that provide a pathway to sustainable livelihoods and decent standards of living to widows and their dependents.

By buying more shares, widows increase their savings, wealth and WISALA capital, providing additional capital for larger loans and earning more interest thus creating a sustainable cycle of capital, credit and savings. WISALA owners use their business income to repay interest and principal and to buy additional shares. They can also pool their equity and cooperate to leverage their businesses.

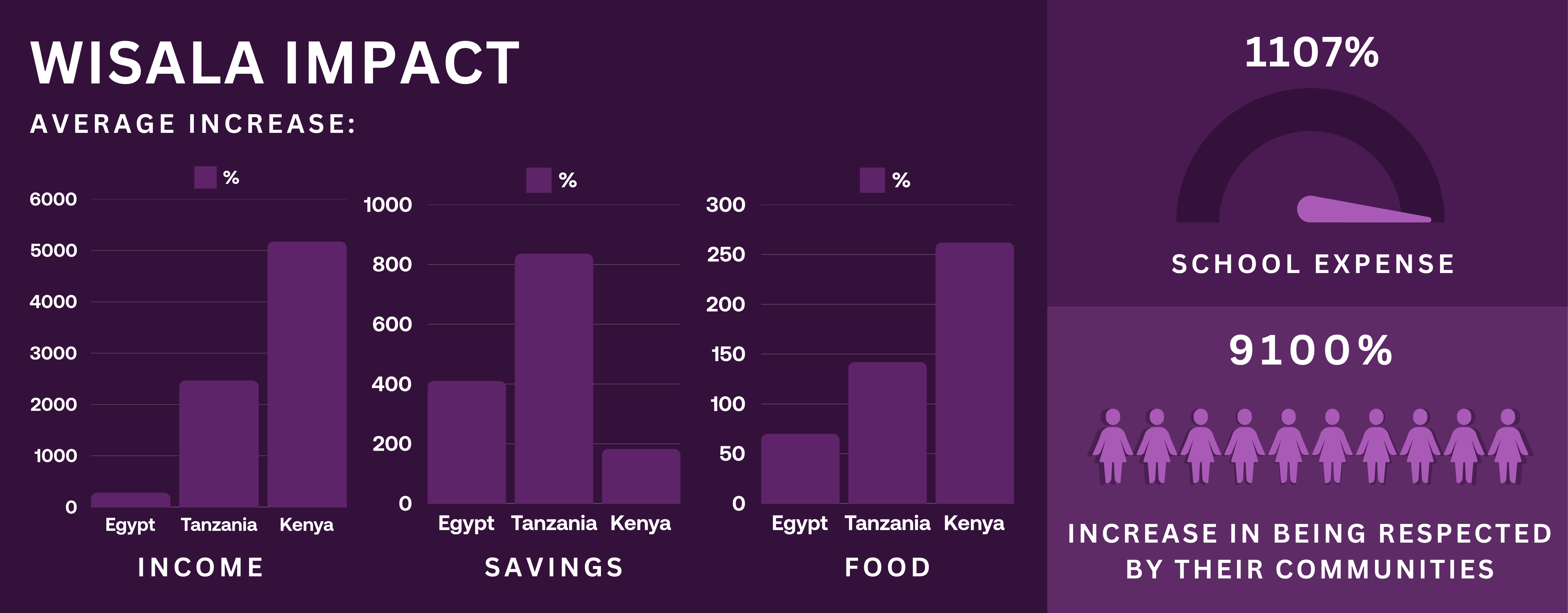

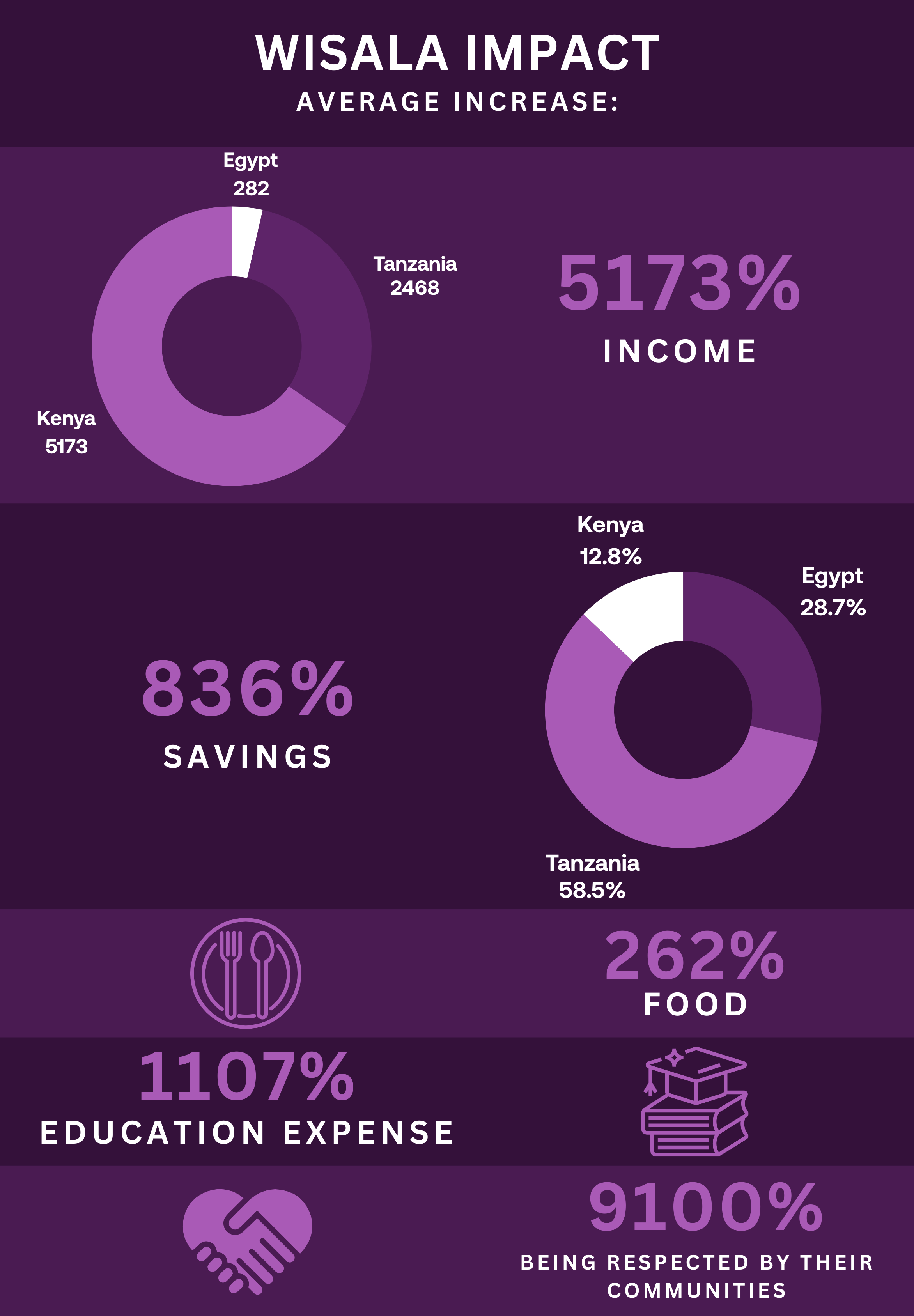

In Longido County, Tanzania, WISALA owners have collectively earned an astounding 60 millionTanzanian Shillings ($22,181).

Using their own money, the WISALA owners have constructed infrastructure for their community, including a new building and toilets with a reliable water source. Their livestock are now safely housed and clean water is accessible. They've also secured means to send their children to school, reducing the risk of child marriage and multigenerational poverty.

Additionally, this$22,000 dollar profit is an example of how donor funds remain circulating within the widows' communities: This money bolsters the local economies oftheir villages, towns and cities through activities such as shopping locally,purchasing in bulk from wholesalers and by hiring tradespeople.

Now, we can see different economic opportunities. You have removed the boundaries we had before. We have business, we make profits, we own things and make decisions.

Widows have multiplied their initial capital by ten in 3 years. That means, for every bank we launch with $2,500, in 3 years, the bank has grown to around $25,000. That is transformative financing for development.

“There is rarely a more damaging status than to be invisible in the eyes of your society. The work of GFW is designed to ensure that widows and their children are heard and seen and can live healthy, stable, and dignified lives.” Graça Machel,

A WISALA is a microbank owned and managed by widows and female heads of households that provides financial services to widows and has been adapted to the specific forms of exclusion widows face. The WISALA model is a wraparound approach that does more grant credit. The model is a three-pronged approach

- that consists of a microbank (including savings, lending),

- that enables entrepreneurship and

- provides a foundation of legal knowledge with which widows challenge their exclusion.

Over 22,000 widows with access to education and finance

The Amal Project is open to widows in over 224 villages in Egypt. Amal includes capacity-building and skills training, equipping women with vocational skills such as poultry farming, hairdressing and food production, alongside financial literacy training. Following training, participants may apply for Amal micro-loans tailored to their business plans ranging from 10,000 to 40,000 EGP ($214–$850 USD) at significantly lower interest rates than commercial micro-finance. Amal participants have a 99% repayment rate and an average 38% rise in income.

DOWNLOAD WHITE PAPER

Our WISALAs have won the Business Council for Peace WOMEN FORWARD – FINANCIAL CATALYST Award –2020! We are honored that our micro-bank innovation has received this esteemed recognition!

LEARN MORE